So if you deposit 25% on a home that would mean the LTV is 75%. Typically LTV is the percent of the home's value not covered by your downpayment.

In our above calculation for individuals we subtract £3 for each £1 of debt for individuals and £2.4 for each £1 of debt for couples with multiple income providers. Lenders presume borrowers spend about 3% to 5% of their outstanding debts on servicing costs. How Much Can I Borrow? Detailed Considerations In June of 2022 the Bank of England pressed ahead with plans to scrap this mortgage affordability test, though borrowers who are stretched should consider what happens to their finances if rates rise. In the wake of the 2008 - 2009 financial crisis the Bank of England implemented mortgage affordability testing rules which aimed to stop banks from offering risky loans where the borrower would be unable to repay the reversion rate on the loan if the rate increased by 3%. Lock in today's low rates and save on your loan.The reason why limits are lower for joint incomes is it is more likely someone will either get laid off or want to voluntarily quit to start a family or go back to school. The Federal Reserve has started to taper their bond buying program. Homeowners May Want to Refinance While Rates Are Low Also, local electric power companies are known to offer low interest loans for specific energy saving home improvements that help them lower their electrical output. On occasion, the federal government will offer rebates or tax credits for innovative products. Home improvement loans for these and other cost saving options are a wise decision.

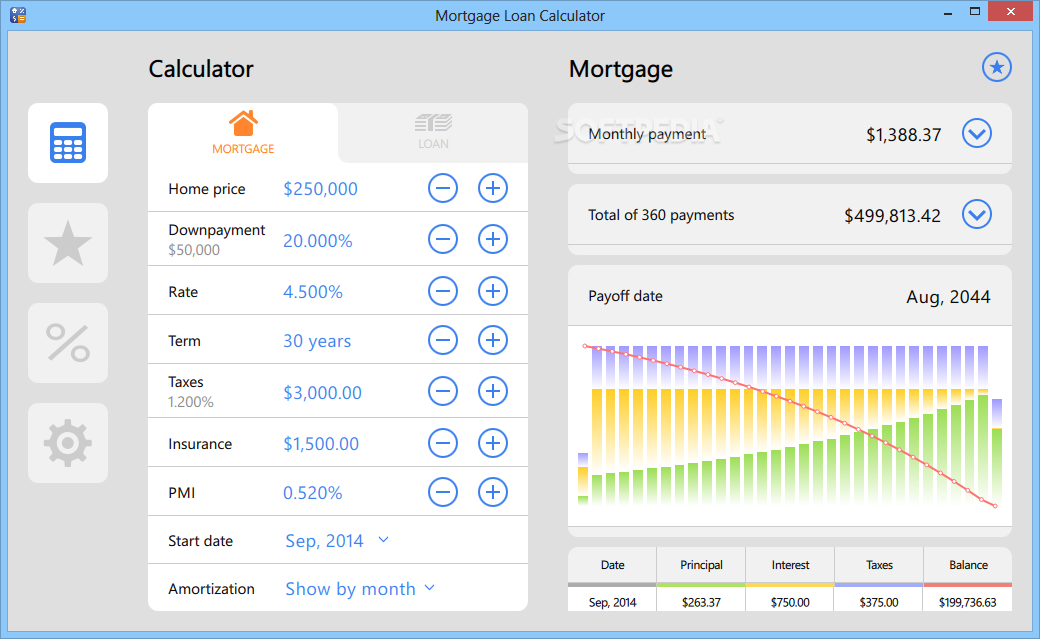

#Mortgage loan calc windows

On the other hand, home improvement products like replacement windows or attic insulation reduce energy consumption and eventually pay for themselves. If you don’t follow their requirements exactly, they can charge interest from the beginning of the loan – some up to 29.9% Home Improvement Loans are a Good Bet No one can deny the pleasure of new furniture, but do you really want to continue making payments five years later on furniture that is old and worn? Many of these loans are advertised as “interest free” if paid off by a stated amount of time. Over the years, furniture companies have extended the loan payments for up to five years. If you are considering a consumer loan, first ask yourself if it’s something you really need now, or can you wait and save for it? Make sure a consumer loan is paid off before the product loses its usefulness. You can check what the credit agencies are reporting about you by visiting and printing out the reports. Equifax, TransUnion, and Experian are the three credit reporting agencies. A better option may be to concentrate on making on-time payments and eliminating some of your existing debt. If your credit score is low, it’s time to ask the question if it’s really wise to take on more debt. But it’s also checked when you rent an apartment and sometimes even when an employer considers you for a job opening. The higher your score the lower interest rate you are offered. Naturally, it’s checked when you apply for a loan because the lender wants to confirm your credit worthiness. Wrongly or rightly, it affects many aspects of your daily living.

The FICO credit score basically measures how well you pay back debt.

Nothing Affects Your Interest Rate like a Bad Credit Score There are caps, which are spelled out in the agreement as to how much the interest rates can increase and how often, so you will know what to expect. But, they also carry the risk of increasing each year. Variable rates begin much lower than fixed rates and are therefore very attractive. If variable, the rate can fluctuate according to the markets. If fixed, you are guaranteed the same monthly payment throughout the life of the loan. You will also see listed an APR (annual percentage rate) which includes the interest rate along with any fees, and in the case of a mortgage, includes points and closing costs. The interest is expressed as a percentage rate. The lower the interest rate, the less you will pay for the total loan. The interest rate determines how much extra you must pay for the privilege of borrowing the money.

There are also consumer loans, home improvement loans and equity loans.Īll loans have something in common called an interest rate. The most common are mortgage loans, car loans and student loans.

0 kommentar(er)

0 kommentar(er)